Welcome to Global Wealth Warrior, your weekly briefing that decodes traditional and crypto markets with a warrior mindset. Each issue distills signals into clear actions you can use to build sovereign wealth and lasting prosperity.

New here or catching up? Subscribe and explore every edition of Global Wealth Warrior on our website.

📝 This Week at a Glance:

Fear Signal: Bitcoin pullbacks push sentiment into extreme fear, a zone that has preceded medium-term bottoms

Market Shift: Risk assets soften while safe-havens hold firm, sharpening this week’s terrain

Equal-Weight Edge: Broad equity exposure offers balanced positioning as market concentration cools

Solana ETF Debut: A new spot-crypto ETF opens fresh terrain for traditional investors exploring altcoin access

Let’s Begin! ⚔️

🗺️ Charted Territory

This Week’s Chart, Mapped and Decoded

Source: CoinMarketCap

Fear Returns to the Battlefield

This week’s chart tracks the CMC Crypto Fear and Greed Index against Bitcoin’s price from June 2023 to now. It shows sentiment sinking toward “Extreme Fear.” It highlights how sentiment repeatedly collapses into fear during selloffs, often near medium-term price bottoms.

What we see: Bitcoin’s pullback is pushing sentiment back into extreme fear even as the long-term uptrend holds.

Why it matters: Past cycles show fear or extreme fear often appears close to medium-term bottoms.

Implication for wealth-building: Extreme sentiment can be a signal to prepare, not panic, when long-range structure stays strong.

📊 Market Maneuvers

This Week’s Market Terrain

🌌 Meta-Signal: Investors are retreating to simplicity as volatility rises, revealing a deeper shift toward patience over prediction.

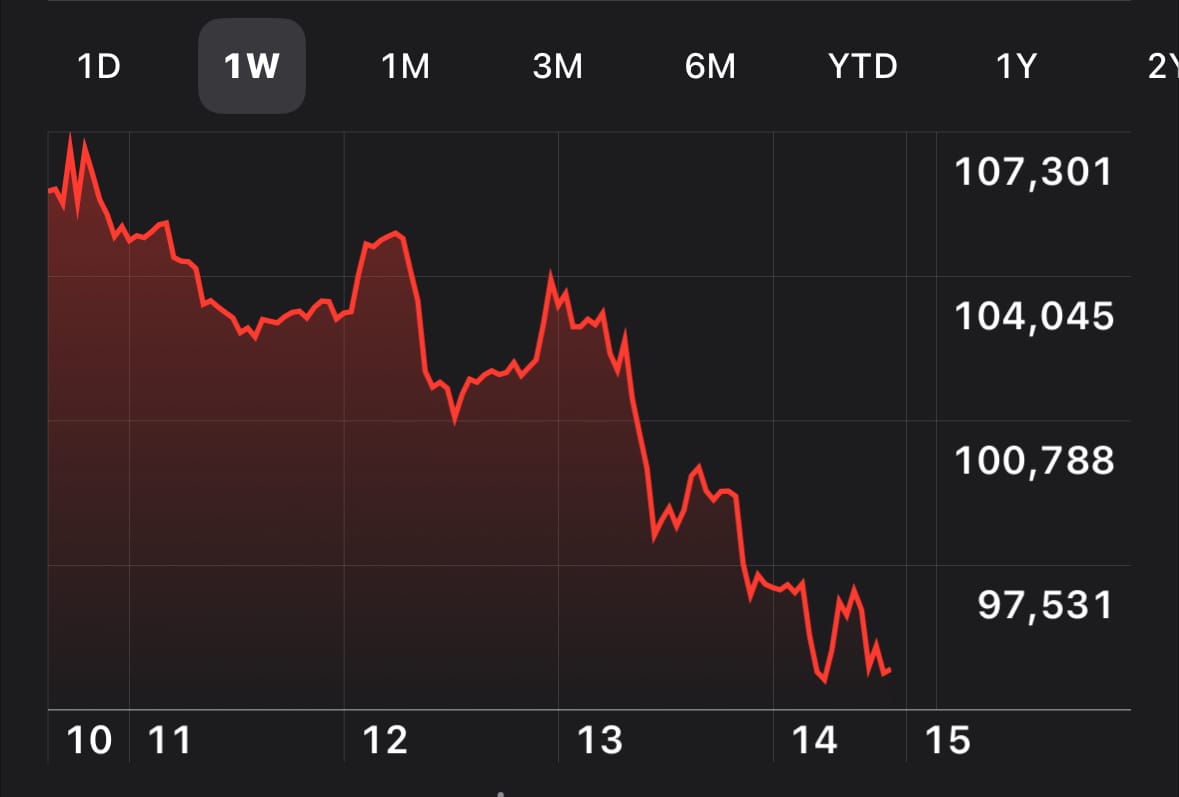

🪙 Bitcoin: Slid below ~$96,000, marking a third straight weekly drop as rate-cut hopes fade

🥇 Gold: Near the ~$4,000/oz level as the dollar strengthened and yields climbed

📈 Equities: The S&P 500 ended the week down slightly amid mixed earnings and macro headwinds

💵 Dollar (DXY): Held around ~99.3, with earlier dips

🎯 Opportunity Radar — Caterpillar:

Consider Caterpillar Inc. (CAT): Global industrial exposure with cyclically leveraged upside as infrastructure flows rise and the dollar stabilizes

For educational purposes only. Not financial advice. Consult a financial advisor before investing.

💰 Wealth in Action

One Trade to Sharpen Your Edge

Positioning With Equal-Weight Strength

Market pullbacks often expose where true underlying strength lives. With mega-cap tech driving most index moves this year, equal-weight exposure offers a cleaner, more balanced way to participate in equities without relying on a handful of giants. When fear rises, broad participation becomes a strategic advantage.

Implementation: Accumulate small positions in the Invesco S&P 500 Equal Weight ETF (RSP) during market dips to rebalance into broader market strength

Reward: Reduces concentration risk and positions you for upside if market breadth improves as fear eases

Guardrail: Size entries conservatively; equal-weight can lag during narrow tech-led rallies

📊 Last week’s Wealth in Action — Schwab U.S. Dividend Equity ETF (SCHD) is now +1.9% since mention.

Balance is a quiet form of strength. Build it before momentum returns.

🌱 Fresh Terrain

One New Investment Reshaping the Landscape

What it is: The BSOL — a newly launched spot-crypto ETF tracking Solana in the U.S. market

Why it matters: It opens more of the altcoin space to traditional ETF investors, signaling a structural shift in crypto access and tokenized capital markets

What to watch: Regulatory risk remains high and liquidity in the product is untested. Adoption and asset flows will be the key success indicators

Disclosure: This content is for educational purposes only and not financial advice. Consult your advisor before making investment decisions.

🫡 At Ease

To wealth that endures,

📣 Final Call

Reflect: Where are you positioning with patience while the market moves through fear?

🕊️ Off Duty